Page 1

Business Rates collected in the Braintree District

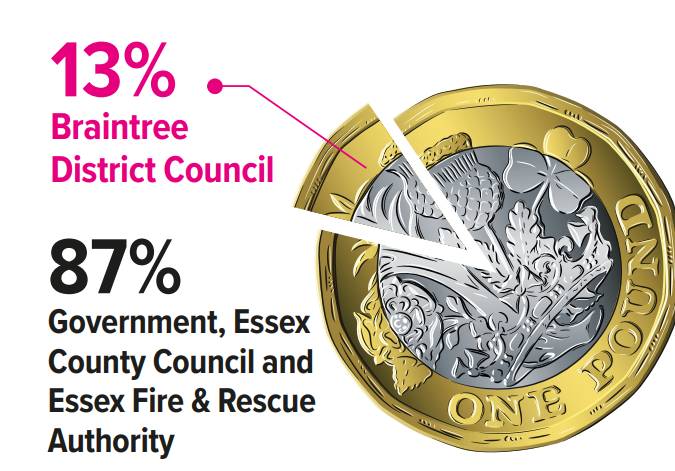

The estimated amount of business rates to be collected from rate payers in 2024/25 is £50.9 million

The Council expects to retain £6.4 million of this amount.

- 13% Braintree District Council

- 87% Government, Essex County Council and Essex Fire & Rescue Authority

Collection Rates

The business rate collection rate for 2022/23 was 98.92%.

In monetary terms, the Council collected £42.813 million out of the £43.279 million due under the precept.

The Council will continue to collect outstanding sums owed until full collection has been achieved.

At the time of publication, the projected Business Rate collection for 2023/24 was approximately 99%.

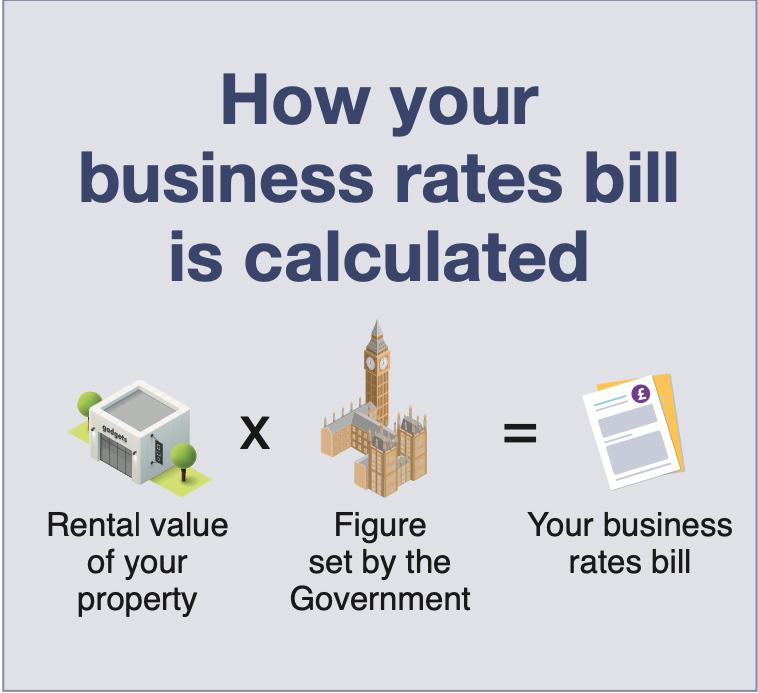

How your business rates bill is calculated

Rental value of your property x Figure set by government = Your business rate bill

Are you entitled to business rate relief?

Small Business Rate Relief

Ratepayers who are not entitled to other mandatory relief or are liable for unoccupied property rates and occupy a property with a rateable value which is below £51,000 will (subject to a small number of exemptions) have their bills calculated using the lower small business non-domestic rating multiplier, rather than the national non-domestic rating multiplier.

In addition, generally, if the sole or main property is shown on the rating list with a rateable value of less than £12,000 the ratepayer will receive 100% relief. If the property has a rateable value between £12,000 and £15,000, the ratepayer will receive relief based on a sliding scale between 100% and 0%. Apply online using www.braintree.gov.uk/raterelief

Generally, this percentage reduction (relief) is only available to ratepayers who occupy either -

- (a) one property, or

- (b) one main property and other additional properties providing those additional properties each have a rateable value which does not exceed £2,899 and the total rateable value of all of the properties is less than £20,000.

Expanded Retail discount

The 2023/24 Retail, Hospitality and Leisure Business Rates Relief scheme will provide eligible, occupied, retail, hospitality and leisure properties with a 75% relief, up to a cash cap limit of £110,000 per business.