Your guide to Business Rates - 2025/2026

Articles in this edition:

- Page 1

- How your business bill calculated

- Transitional Relief

- Page 2

- Collection Rates (including - Small Business Rate Relief, Retail, Hospitality and Leisure Relief, Charitable and Discretionary Rate Relief, Supporting Small Business Relief, Rural Rate Relief and Rating of Unoccupied Non-Domestic Properties)

- Appeals against Business Rate bills

- Page 3

- Rating Advisors

- Information supplied with Demand Notices

- Open Portal

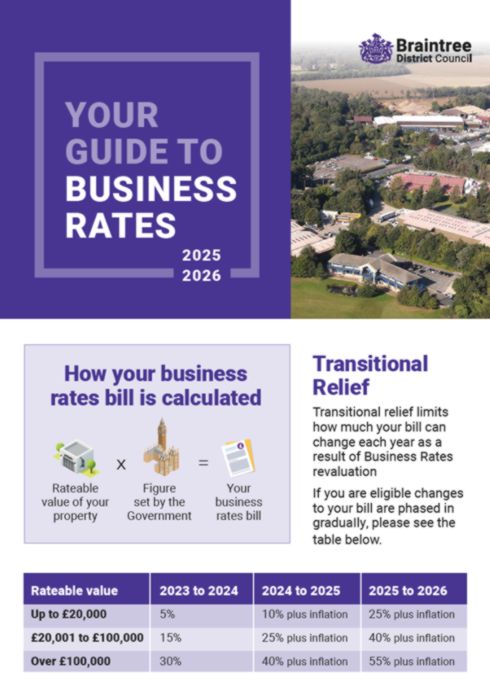

How your business rates bill is calculated

Rateable value of your property x Figure set by the Government = Your business rates bill

Transitional Relief

Transitional relief limits how much your bill can change each year as a result of Business Rates revaluation.

If you are eligible changes to your bill are phased in graduaIly, please see the table below.

| Rateable value | 2023 to 2024 | 2024 to 2025 | 2025 to 2026 |

|---|---|---|---|

| Up to £20,000 | 5% | 10% plus inflation | 25% plus inflation |

| £20,001 to £100,000 | 15% | 25% plus inflation | 40% plus inflation |

| Over £100,000 | 30% | 40% plus inflation | 55% plus inflation |

Collection Rates

The business rate collection rate for 2023/24 was 98%.

In monetary terms, the Council collected £46.0 million out of the £46.9 million due under the precept.

The Council will continue to collect outstanding sums owed until full collection has been achieved. At the time of publication, the projected Business Rate collection for 2024/25 was approximately 98%.

The estimated amount of business rates to be collected from rate payers in 2025/26 is £53.6 million. The Council expects to retain £6.9 million of this amount. Every pound collected is distributed as follows:

- 13p - Braintree District Council

- 87p - Government, Essex County Council and Essex Fire and Rescue Authority

Small Business Rate Relief

Ratepayers who are not entitled to other mandatory relief or are liable for unoccupied property rates and occupy a property with a rateable value which is below £51,000 will (subject to a small number of exemptions) have their bills calculated using the lower small business non-domestic rating multiplier, rather than the national non-domestic rating multiplier.

In addition, generally, if the sole or main property is shown on the rating list with a rateable value of less than £12,000 the ratepayer will receive 100% relief. If the property has a rateable value between £12,000 and £15,000, the ratepayer will receive relief based on a sliding scale between 100% and 0%. Apply online.

Generally, this percentage reduction (relief) is only available to ratepayers who occupy either:

- (a) one property, or

- (b) one main property and other additional properties providing those additional properties each have a rateable value which does not exceed £2,899 and the total rateable value of all of the properties is less than £20,000.

Retail, Hospitality and Leisure Relief

The 2025/26 Retail, Hospitality and Leisure Business Rates Relief scheme will provide eligible, occupied, retail, hospitality and leisure properties with a 40% relief, up to a cash cap limit of £110,000 per business.

Charitable and Discretionary Rate Relief

Charities and registered Community Amateur Sports Clubs (CASC) are entitled to 80% mandatory relief where the property is occupied by the charity or a CASC. Braintree District Council has discretion to give further discretionary relief up to 100% to non-profit making organisations and clubs. Apply online.

Supporting Small Business Relief

Supporting small business rates relief (SSB) has been introduced by Central Government with the aim to help those ratepayers who, as a result of the 2023 revaluation lost some or all of their small business or rural rate reliefs. This scheme will run for 3 years from 2023 to 2026.

Rural Rate Relief

You could get rural rate relief if your business is in a rural settlement area with a population below 3,000.

You will not pay business rates if your business is in an eligible area and either:

- the only village shop or post office, with a rateable value of up to £8,500

- the only public house or petrol station, with a rateable value of up to £12,500.

Rating of Unoccupied Non-Domestic Properties

The unoccupied exemption applies to the property, not the liable person/company.

The owner of a non-domestic property becomes liable to unoccupied rates when the whole hereditament has been unoccupied for a continuous period of 3 months, or in the case of industrial property, 6 months.

If you become liable for a property which was previously unoccupied for 2 months, you will only be eligible for 1 further month exemption if the property remains unoccupied. A change of ownership will not give rise to a new period of exemption and the unoccupied charge is currently 100% of the occupied charge.

There are some exemptions from the unoccupied rate. For the full list please visit our website.

Appeals Against Business Rate bills

If you disagree with the amount you are asked to pay, because you are not the liable person, you feel that you are entitled to some type of relief, or that the property should be exempt, please contact the Business Rates team on 01376 557788.

For Appeals against your Rateable Value, please contact the Valuation Office Agency National Helpline on 03000 501501 or contact the VOA.

Rating Advisers

Ratepayers do not have to be represented in discussions about rateable value or their rates bill. Appeals against rateable values can be made free of charge. However, ratepayers who do wish to be represented should be aware that members of the Royal Institution of Chartered Surveyors (RICS) and the Institute of Revenues, Rating and Valuation (IRRV) are qualified and are regulated by rules of professional conduct designed to protect the public from misconduct.

Before you employ a Rating Adviser, you should check that they have the necessary knowledge and expertise as well as the appropriate indemnity insurance. Take great care and if necessary, seek further advice before entering into any contract.

Information Supplied with Demand Notices

Information relating to spending by the council in the financial year is available on our website.

Need more information?

Local authorities are no longer required to provide individual copies of explanatory notes when bills are issued but you can find more explanatory notes on our website. A hard copy is available by writing to the Council or by calling us on 01376 557788.

Open Portal

Sign up to Open Portal to view your Business Rate bill online, request a bill, view instalments and check payment dates.

You will need your bill reference number.

For added security your password will be posted within 7 days of registering.

You may need to download Adobe Acrobat onto your device.

If you have any queries please contact Revenues on 01376 557755 or email busrates@braintree.gov.uk.

If you require this leaflet in an alternative format, please call 01376 557788.

Our Business Rates Team can be contacted on busrates@braintree.gov.uk or call 01376 557788.